It isn’t a secret that the average dental student leaves school with close to $300,000 in debt. The debt they accrue sets their future life up for tight budgeting, stress, and a high debt-to-income ratio. What is this debt paying for? Why is dental school so expensive?

Some dentists go into school looking only at the tuition rates. After all, the tuition at one of the most expensive dental schools in the nation, New York University School of Dentistry, is around $88,700. But, take a close look at their cost of attendance chart and you’ll notice the often-overlooked expenses: fees, living expenses, instruments, health coverage, and even disability insurance.

Not every dental school so openly shares these costs. Most dentists in training decide in financial aid offices to take out additional student loans to live on while in school. In this article, you’ll learn more about the hidden fees in dental education.

If you are struggling with your student loans, the best way to get clarity is to talk with an expert. Loyall Group can connect you with nationally recognized affiliates who can discuss your personal situation with you. Contact us to learn more.

Dental Education Moved Away from Apprenticeship

We start with a brief history of dental education. Dentists didn’t always have to go to school to start practicing. The first formal dental education in the United States began in 1840 with the Baltimore College of Dental Surgery. During most of the nineteenth century, dentist schools were limited, and most dentists were apprenticed in order to learn. Indeed, one of the main reasons for this was the expense of the equipment.

Nevertheless, by 1900 our country had 57 dental schools. According to the Institute of Medicine (US) Committee on the Future of Dental Education, by the 1920s, most dentists were being trained in a school rather than an apprenticeship. The shift towards formal, university-based education also eradicated proprietary “for-profit” dental schools, mainly because it was too expensive to train dentists.

One reason for the expense included an increase in research on proper dental methods. Other reasons were supplies, equipment, and teaching salaries. Flexner and Gies’ reports on medical training also impacted dental education. They both advocated for higher standards, dentistry to be treated similarly to medical professions, and education to be based on research and professional studies. Each of these recommendations meant additional funds needed to raise the quality of dental education. While these changes ensured that dentists were making a difference in the lives of their patients, it also meant higher fees to get the education and training.

Why Dental School Fees Are Higher than Medical School

Raising the bar for dental education brought dentists to the same level of education as medical doctors. Both professions require a four-year undergraduate degree as well as four-year graduate degree. But, the fees in a dental school are higher than those in medical school. Generally, this is due to two reasons.

First, a dental school runs a dental clinic in which dental students perform treatments. In the clinic, predoctoral students perform procedures on patients under the supervision of faculty at the school. While most clinics charge fees (just like a dental office), the fees often do not cover the cost required to operate the clinic. This varies from a medical physician, who usually performs a residency at a clinic within a hospital.

Secondly, dentists have to purchase their equipment and tools in dental school, or pay a fee to rent them from the school. Most colleges will allow the dentist to take the tools with them after graduation, so this could be seen as an investment.

Even after graduation, orthodontists and other dental specialists need to be aware of ongoing costs associated with their profession. Disability Insurance is a lifeline to continuing to pay student loans in the event of an illness or accident. Life insurance protects your family and business and gives you peace of mind that they won’t be saddled with high student loan debt in case of a premature death. Malpractice Insurance protects you within your practice, and keeps you working through whatever life brings you. If you have questions on any of these key insurances, reach out to Loyall Group today. We walk with orthodontists through the insurance that you need, making it a simple and easy process.

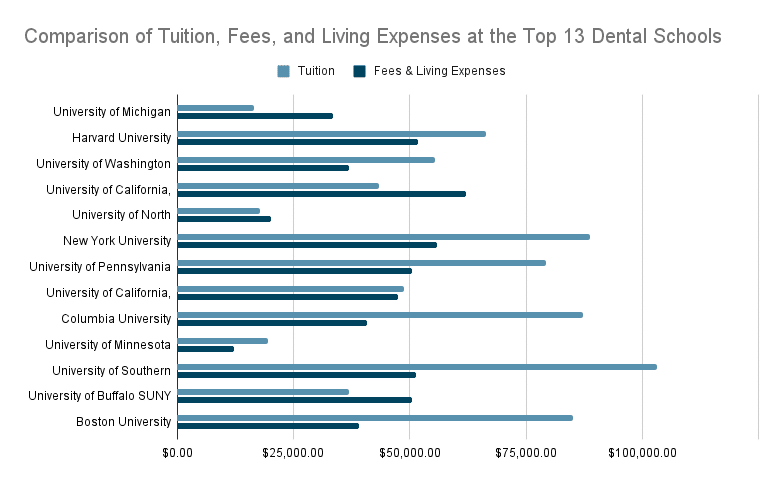

Comparing the Top 13 Dental Schools in America Based on Fees and Living Expenses

Now let’s compare the top dental schools in the United States to see how much extra money a student will need over the cost of tuition to attend. Usually, dental school comes with so much rigor that a student needs to devote their entire time to school, instead of working their way through. Since dental school is a four-year degree after your bachelor’s degree, this means you’ll need a way to pay for a living while studying.

For the chart below, the costs are yearly, based on an in-state resident student who is full-time.

Stats are from College websites and CollegeFinance.com.

Take note that for most schools, disability insurance is required while in school, and is part of the student fees. It is important to protect your biggest asset while investing in education: you. If you were suddenly sick or had an accident, and you couldn’t practice, what would happen to your student loans? They would still be there. But some disability carriers today offer a rider to help protect you against defaulting on student loans. Contact Loyall Group today to learn more about how to protect yourself, your family, and your practice through this vital insurance.

Taking Out Loans for Tuition… and Student Fees, Books, Living Expenses, and Instruments

The chart above shows us that oftentimes, fees and living expenses are on par with tuition rates or exceeding the cost of tuition. What pays for all these costs? Student loans. Marilyn J. Field writes in a report from the Committee on the Future of Dental Education that “High student tuition is one of the most acute quality-of-life problems for many dental students and a major worry for dental educators.”

If you are an aspiring dental student, ask questions when applying to schools. The American Dental Education Association gives a pathway to financing your education through multiple options. Try to keep your personal living expenses low, and only borrow what you absolutely need.

And, if you are already a practicing dentist or orthodontist, take charge of your student loan repayment. Know your options by connecting with a nationally recognized student loan counselor. You’ll get a personalized 15-minute phone call that can give you a strategy that works for you. Contact Loyall Group today to get connected.